Taxes fell in the GFC due to the collapse of many business worldwide.

Prior to the GST Company’s paid 5% of GDP in taxes. Due to Globalisation and profit shifting this has fallen to 4.6% of GDP.

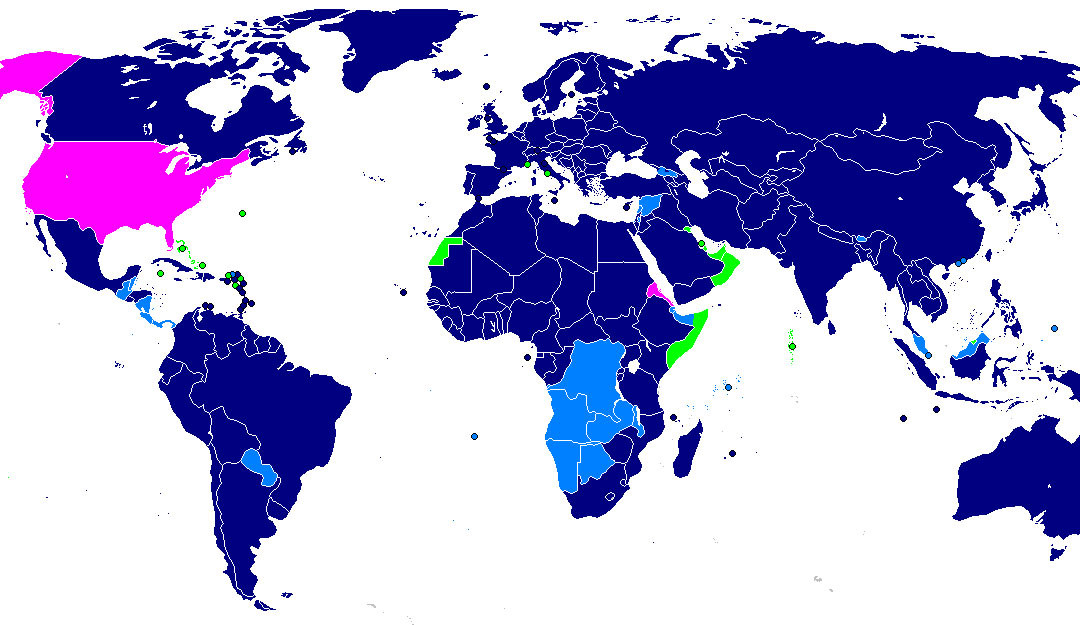

The GFC clearly put pressure on business and its reaction was to shift profits worldwide to reduce tax. Small business never had this opportunity.

On the other hand tax on individuals has increased by 2.2% as government goes after an easy target.

The population are told the medibank levy is increasing ½ for the disability scheme as an example how easy it is to raise taxes. As well Living Away from Home Allowance and Medical Rebate claim deductions are slashed. This create billions of dollars for government by hitting individuals.

Roger Brake from Treasury thinks this trend will probably accelerate and falling revenue from tobacco and beer consumption will have to be recovered. Individuals are the likely target.

Let’s hope all individuals contribute not just some.

By Terry Murphy Simple Economics 21/8/16 forster@accountingandmore.com.au

Photo Wikipedia.